Global supply chains have experienced ongoing and unprecedented disruption since 2020. The challenges presented by a “perfect storm” of multiple factors have forced businesses across the world to reassess how products are moved around on a regional, national and international level

Localisation for shorter supply chains, running multiple smaller manufacturing plants rather than one large site, and using more than one supplier are three major steps that can be taken to boost resilience. However, taking these measures can be expensive, which increases costs along the supply chain and for consumers – and ultimately drives up inflation.

"Once the factories were not fulfilling supply, the transportation piece of the supply chain also began to falter. Many companies did not have a plan in place for this."

More than 2/3 of managers and executives worldwide agreed that the biggest risks to their business are:

- Geopolitical tensions

- Supply chain transparency

- Cyber attacks on supply chains

The view of supply chains is changing

Disruption of existing supplier relationships, particularly for long-distance deliveries, is a growing trend among many businesses and industry sectors. As many as 59% of survey respondents have created alternative supply chains, indicating that the current structure of supply chains is undergoing a truly significant transformation. The fact that, according to up to 88% of respondents, supply interruptions occurred during the last 18 months also contributed to the optimization of supply chains. These gave companies clear feedback that their supply chains were facing serious shortfalls that needed to be addressed.

Before the coronavirus pandemic, many global supply chains were optimized to maximize efficiency, reduce costs and ensure improved financial performance. But this strategy relies on supply chains that work efficiently almost all the time. The last two years have shown that does not always happen. In Europe, business leaders are already aware of the need to balance efficiency with resilience. At the time of our global research, more companies were already favouring resilience (41%) over efficiency (12%). In all regions is expected a significant shift to optimise towards resilience over the next 5 years.

European leaders also have an aboveaverage level of knowledge of lower-tier suppliers, with 39% claiming visibility up to tier three (compared to a global average of 32%). Nevertheless, 64% of European businesses are planning to diversify their supply chains in the next 18 months and 35% are planning to invest in technology for supply chain analytics, while 21% will be introducing dual sourcing of raw materials and 27% are looking to hire more digital talent to improve resilience and flexibility of supplies.

European leaders also have an aboveaverage level of knowledge of lower-tier suppliers, with 39% claiming visibility up to tier three (compared to a global average of 32%). Nevertheless, 64% of European businesses are planning to diversify their supply chains in the next 18 months and 35% are planning to invest in technology for supply chain analytics, while 21% will be introducing dual sourcing of raw materials and 27% are looking to hire more digital talent to improve resilience and flexibility of supplies.

Cybernetic VS. climate threats

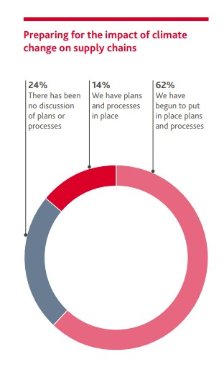

Global concerns about the impact of cyber attacks have skyrocketed over the past year. According to the results of the survey, companies feel much more unprepared for cybercrime compared to previous years. But European leaders appear to be slightly less worried about cyber attacks than the rest of the world. They identified climate change and natural disasters as the number 1 threat to supply chains. Extreme weather phenomena, such as floods, hurricanes, fires, regional droughts, which can threaten supply chains, have opened up discussions at the level of company management about changing processes in connection with the impact of such climatic threats, and this is only in the case of 62% of the questioned companies.

For an even deeper dive into the key findings of the Global Risk Landscape study, take a look at the interactive graphic below. Using the red gear icon in the lower right corner of each slide, you can set your display preference:

"Companies that take a proactive approach to building supply chain resilience with a focus on sustainability will be in a strong position to weather future storms in the coming years."

You can get much more interesting information by downloading the entire Global Risk Landscape publication, as well as global risk report for 2022 focused on the Europe.